Interior design is shaping how people live, work, and use space across homes, offices, and commercial environments. Growing urbanization, lifestyle changes, and renovation demand continue to drive the industry forward, while new services and premium design options further expand the market.

In this listicle roundup, you will find the most important interior design statistics that explain market size, growth trends, career demand, and regional opportunities.

All data are sourced from trusted industry reports and research, with references provided at the end for full transparency.

Key Interior Design Statistics

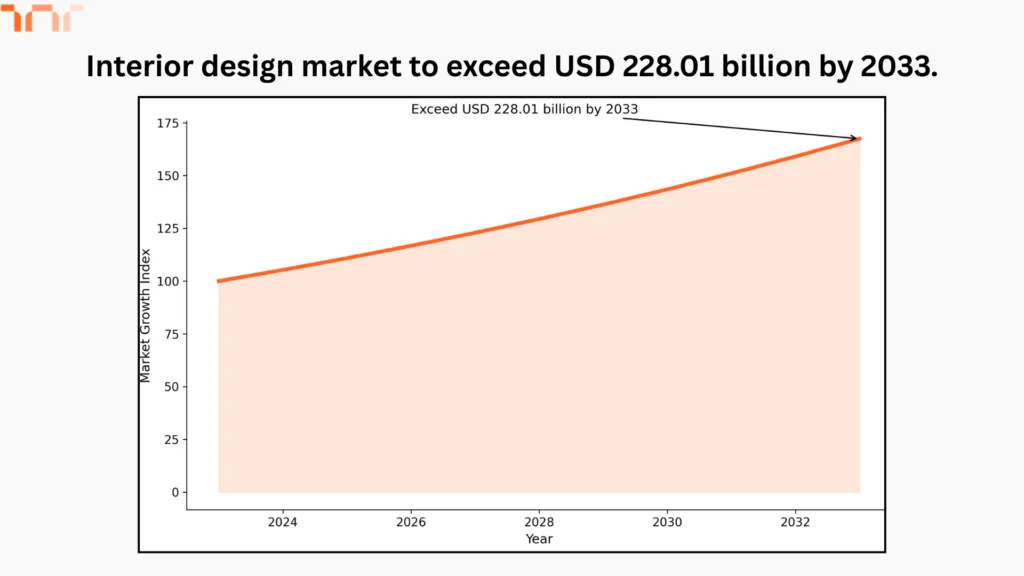

- The global interior design market is expected to exceed USD 228.01 billion by 2033, growing at a 5.29% CAGR.

- The market size stood at USD 137.93 billion in 2024 and is projected to reach USD 175.74 billion by 2030.

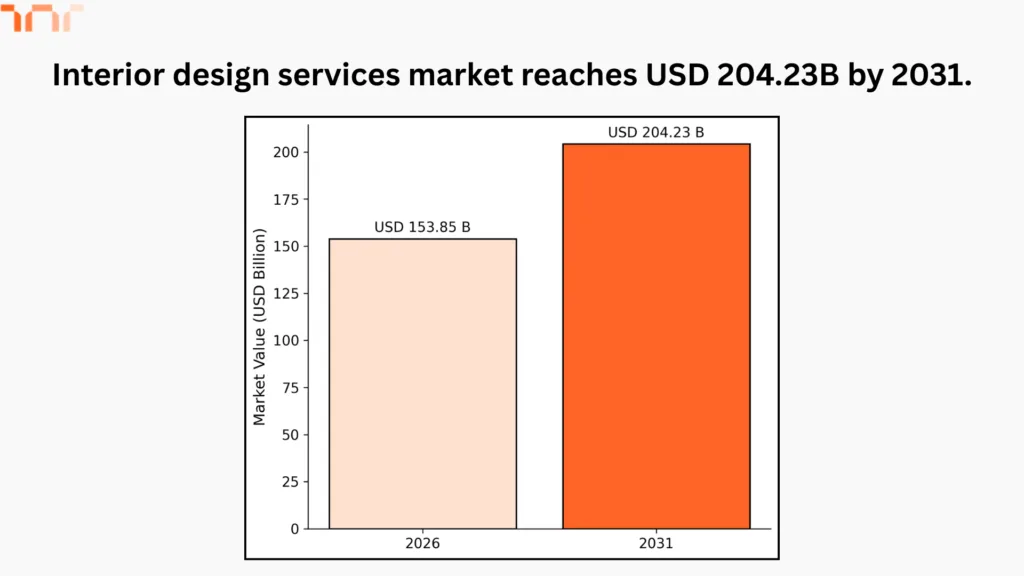

- The interior design services market is forecast to grow from USD 153.85 billion in 2026 to USD 204.23 billion by 2031.

- Revenue in the global home décor market is expected to reach US$128.60 billion in 2026.

- The median annual salary for interior designers in 2024 is USD 63,490.

- Interior designer employment is projected to grow by 3% from 2024 to 2034, with 7,800 job openings each year.

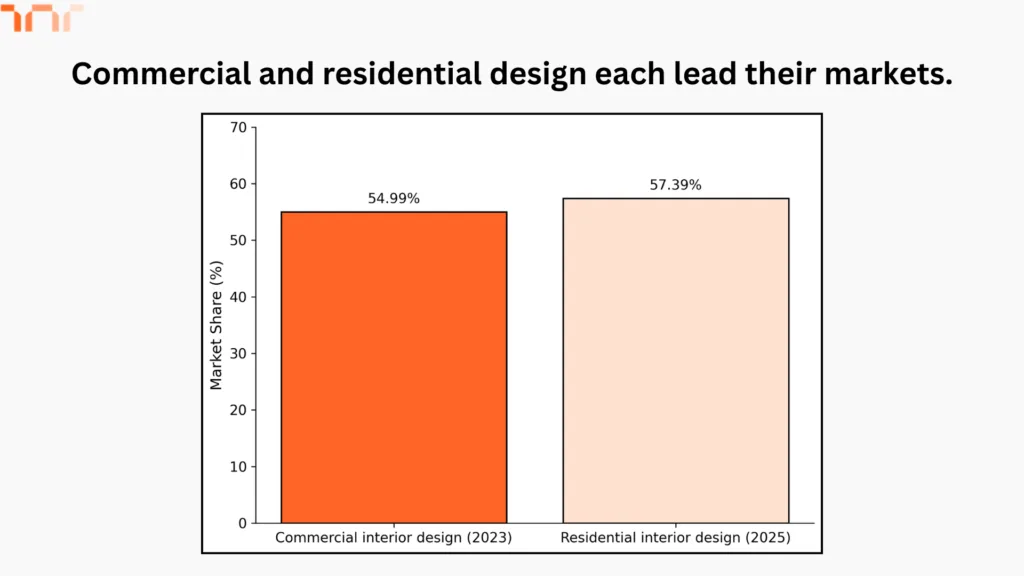

- Commercial interior design accounted for 54.99% of the market share in 2023.

- Residential interior design services held 57.39% of the services market in 2025.

- Premium and luxury interior design services are expected to grow at a 13.84% CAGR through 2031.

- North America led the global market in 2024 with a 34% share, followed by Europe and the Asia Pacific.

1. Global interior design and home décor market size and growth

The global interior design and home décor market exhibits steady, long-term growth. Market size continues to rise across design services, core interior work, and home décor spending.

Here, you understand the overall scale of the interior design and home décor industry. The data explains current market value, future size, and growth rate. It provides a clear picture of how rapidly the industry is expanding and how strong long-term global demand appears.

- The global interior design market is expected to exceed USD 228.01 billion by 2033, growing at a CAGR of 5.29% from 2023 to 2033.

- The market size was USD 137.93 billion in 2024 and is projected to reach USD 175.74 billion by 2030, growing at a CAGR of 4.3%.

- The interior design services market is valued at USD 153.85 billion in 2026 and is projected to reach USD 204.23 billion by 2031, with a 5.83% CAGR.

- The interior design market is projected to grow at a CAGR of 5.45% from 2024 to 2032.

- Revenue from interior design activities is expected to reach £1.9 billion by 2025–26, growing at a 3% compound annual growth rate.

- Revenue in the home décor market is expected to reach US$128.60 billion in 2026, with annual growth of 2.52% from 2026 to 2030.

2. Employment, salary, and job outlook

Employment and career data show steady demand for interior designers with stable income levels. This category focuses on people and careers in interior design. It covers earnings, hiring trends, and expected job openings. The data help evaluate income potential, workforce demand, and the expected stability of interior design roles over the coming years.

- The median pay for interior designers in 2024 is USD 63,490 per year or USD 30.52 per hour.

- Employment for interior designers is projected to grow by 3% from 2024 to 2034.

- Around 7,800 job openings for interior designers are expected each year over the next decade.

- Leadership roles surged 18%, and design roles grew across the board. However, “other” interior design employees, librarians, assistants, BIM specialists, etc., decreased by 26%, resulting in an overall 11% staff reduction, suggesting firms are still right-sizing.

3. Residential and commercial market structure

This part explains where interior design work comes from. It compares residential and commercial demand and highlights which segment dominates today and which is growing faster. The insights help identify which types of projects offer better volume and long-term growth opportunities.

- Commercial interior design accounted for 54.99% of the market share in 2023.

- Residential interior design held 57.39% of the interior design services market in 2025.

- ‘Residential interior design services are projected to grow at a CAGR of 4.5% from 2024 to 2030.

- Commercial interior design services are projected to grow at a CAGR of 12.26% through 2031.

4. Service type and pricing segments

Service and pricing data show how clients choose interior design offerings. Market share figures highlight where most spending occurs today, while growth trends indicate rising demand for higher-value services. This data helps understand client budget behavior, popular service levels, and how design businesses can position offerings across mid-range and premium segments.

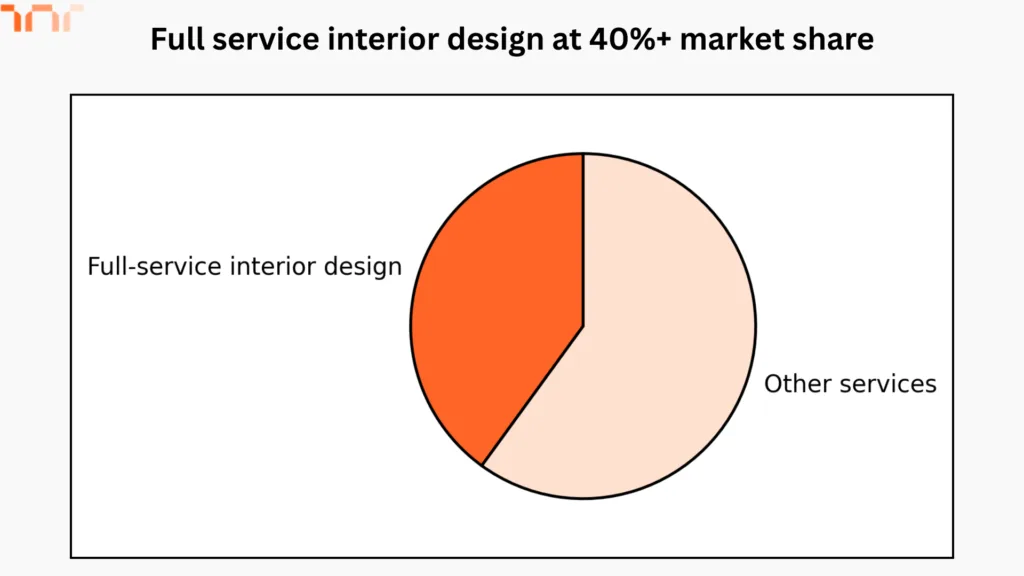

- Full-service interior design was the largest service category, accounting for over 40% of the market in 2024.

- Mid-range interior design services held 53.37% of the market share in 2025.

- Premium and luxury interior design services are projected to grow at a CAGR of 13.84% through 2031.

5. Remodeling and application trends

Remodeling and application data highlights where interior design work is most active. Growth figures indicate rising demand for renovation projects, while application shares reveal which spaces drive the most design work. This helps identify high-demand project types and understand how homeowners and clients prioritize design improvements within existing spaces.

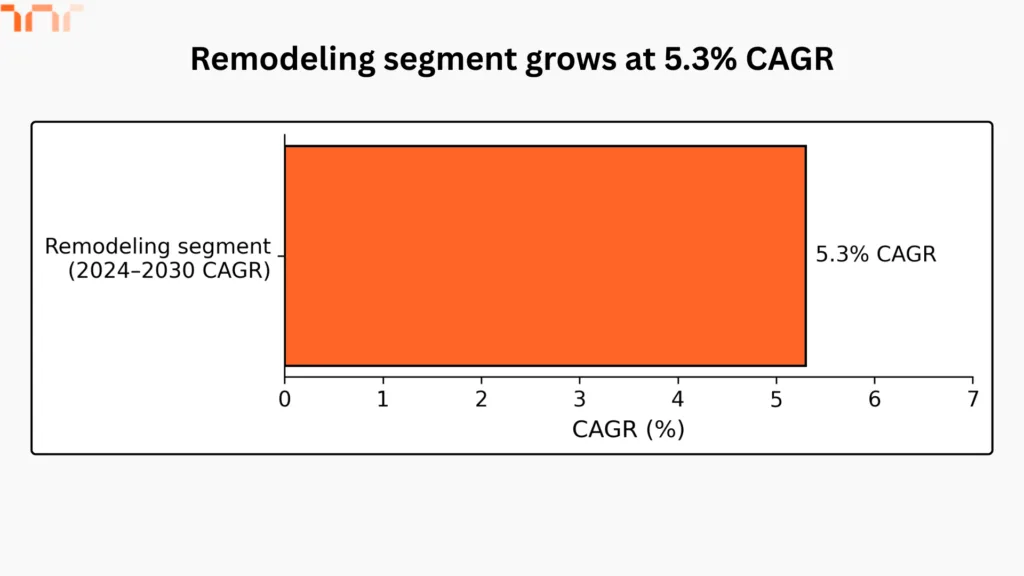

- The remodeling segment is projected to grow at a 5.3% CAGR from 2024 to 2030.

- Living room design accounted for the largest share of the application segments, with approximately 30% in 2024.

6. Regional market share and growth

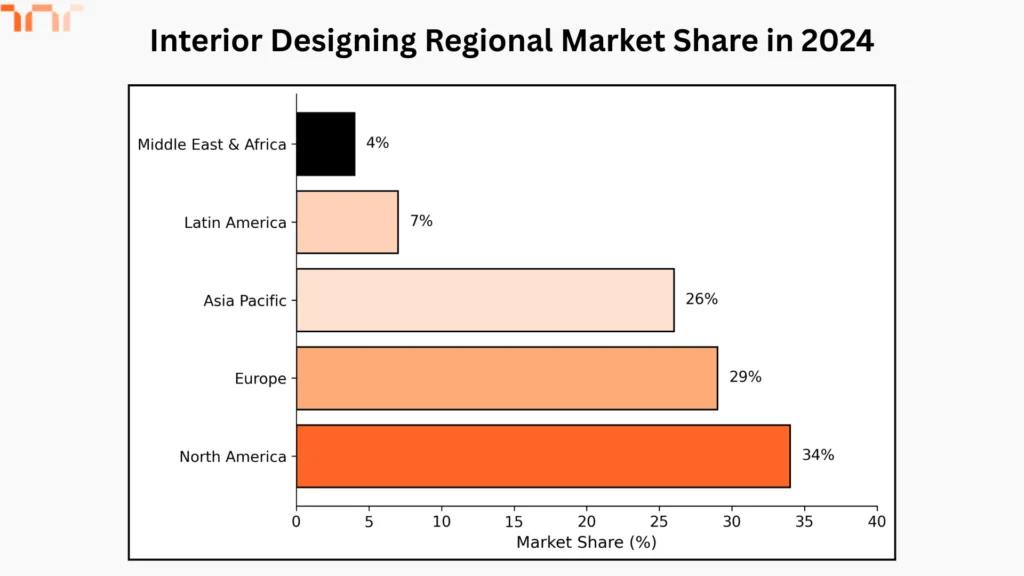

Regional market data explains how interior design demand is distributed across major global regions. Market share figures show where most business comes from today, while growth rates highlight emerging regions with faster expansion. This overview helps compare mature markets with high-growth regions and understand where future opportunities are likely to develop.

- North America led the global interior design market with a 34% share in 2024.

- Europe accounted for 29% of the global market in 2024.

- Asia Pacific accounted for 26% of the global market share in 2024.

- Latin America accounted for approximately 7% of the global market share in 2024.

- The Middle East and Africa held about 4% of the global market share in 2024.

- The Middle East and Africa region is expected to grow at a CAGR of 17.33% through 2031.

7. Top firms and industry scale

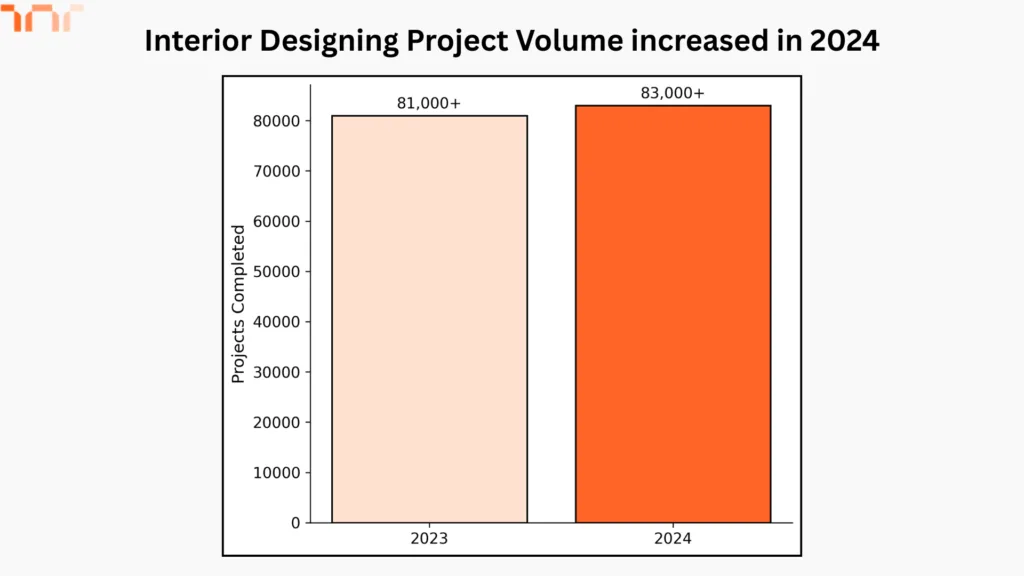

Industry scale data highlights the size and output of leading interior design firms. Revenue figures indicate the extent to which the top players have grown, while growth rates indicate rising demand. Project volume data reflects the scale of operations and workload handled by major firms, helping assess how consolidated and active the industry is at the top level.

- The top 100 interior design firms crossed USD 5 billion in fees for the first time in 2023.

- These firms generated USD 6.3 billion in interior design fees in 2024, representing 7% year-over-year growth.

- The top firms completed more than 83,000 projects in 2024, up from nearly 81,000 projects in 2023.

8. Project mix and sector performance

Here, the focus remains on the types of projects and sectors that drive design work. It covers construction, renovation, and sector-specific trends such as hospitality and offices. The data shows how spending patterns and sector demand are changing over time.

- In 2024, interior designing projects included 48% new construction, 45% renovation, and 7% cosmetic refresh.

- Hospitality design projects grew 11% year over year but remain 13% below pre-pandemic levels.

- Corporate office design declined 5% year over year and is 18% lower than 2019 levels.

- Transportation sector design work increased by 38% year over year.

- Furniture, fixtures, and equipment accounted for 50% of total project spending in 2024, overtaking construction for the first time.

👉Further Resources :

- How to Become An Interior Designer In 7 Simple Steps

- Interior Design Courses After 12th (Fees & Duration)

Final Words

Interior design statistics indicate a strong, stable industry with long-term growth across markets, services, and regions. Rising demand for residential, commercial, and renovation projects highlights expanding opportunities for designers and firms. Career data indicate steady hiring and reliable income potential, while regional and service-level trends reveal where future growth is strongest.

Together, these insights help students, professionals, and businesses understand market direction, plan careers, and make informed decisions in the evolving interior design industry.

FAQs

How big is the global interior design market?

The global interior design market was valued at USD 137.93 billion in 2024 and is expected to exceed USD 228.01 billion by 2033. This growth reflects steady demand across residential, commercial, and service-based interior design segments worldwide.

Is interior design a good career choice in the coming years?

Yes, interior design offers stable career prospects with consistent demand. Employment is projected to grow by 3% from 2024 to 2034, with around 7,800 job openings expected each year across the industry.

What is the average salary of an interior designer?

The median salary for interior designers in 2024 is USD 63,490 per year or USD 30.52 per hour. Earnings can vary based on experience level, region, specialization, and the type of projects handled.

Which segment dominates the interior design market?

Commercial interior design currently dominates the market with a 54.99% share as of 2023. Residential interior design also holds a large portion of the market and continues to grow steadily due to renovation and home improvement demand.

Which interior design services are growing the fastest?

Premium and luxury interior design services are growing the fastest, with a projected CAGR of 13.84% through 2031. Commercial interior design services are also growing faster than other segments.

Which region leads the global interior design market?

North America leads the global interior design market with a 34% share in 2024. Europe and the Asia Pacific follow closely, while the Middle East and Africa region shows the highest projected growth rate.

Data Sources

- https://www.sphericalinsights.com/reports/interior-design-market

- https://www.statista.com/outlook/cmo/furniture/home-decor/worldwide#revenue

- https://www.bls.gov/ooh/arts-and-design/interior-designers.htm

- https://www.grandviewresearch.com/industry-analysis/interior-design-market-report

- https://www.ibisworld.com/united-kingdom/industry/interior-design-activities/14549/#GeographicBreakdown

- https://www.mordorintelligence.com/industry-reports/interior-design-services-market

- https://interiordesign.net/research/interior-designs-2025-top-100-giants/

- https://www.credenceresearch.com/report/interior-design-market

Jasmine Ahluwalia is a Licensed Architect, Interior designer, Global Vastu consultant and the founder of ASDAV.

She is a graduate of Scuola Master F.lli Pesenti, Politecnico di Milano, and brings strong global exposure through academic learning and professional design projects. Her background combines architecture, interior design, and applied design education.

Before founding ASDAV, Jasmine worked as an assistant professor at Amity School of Architecture and Planning, Amity University Noida. Her research covers sustainable architecture, urban heat island reduction, and circular economy practices in construction. Her work has been published in Scopus indexed and peer reviewed journals as well. She also has strong international on-site experience from countries like Canada, Mauritius, UK, and many more.

Through ASDAV, she has trained more than 500 students across 25 cities. The ASDAV platform has 12+ instructors from IIT, SPA, CEPT and NID , and has delivered over 200 live learning sessions. Her mission is to bridge the gap between design education and real industry expectations, to deliver real growth for her students.

She designs spaces for a living, but her favourite project is designing careers.